ATO Cents Per Kilometre Mileage Rate 2024-2025

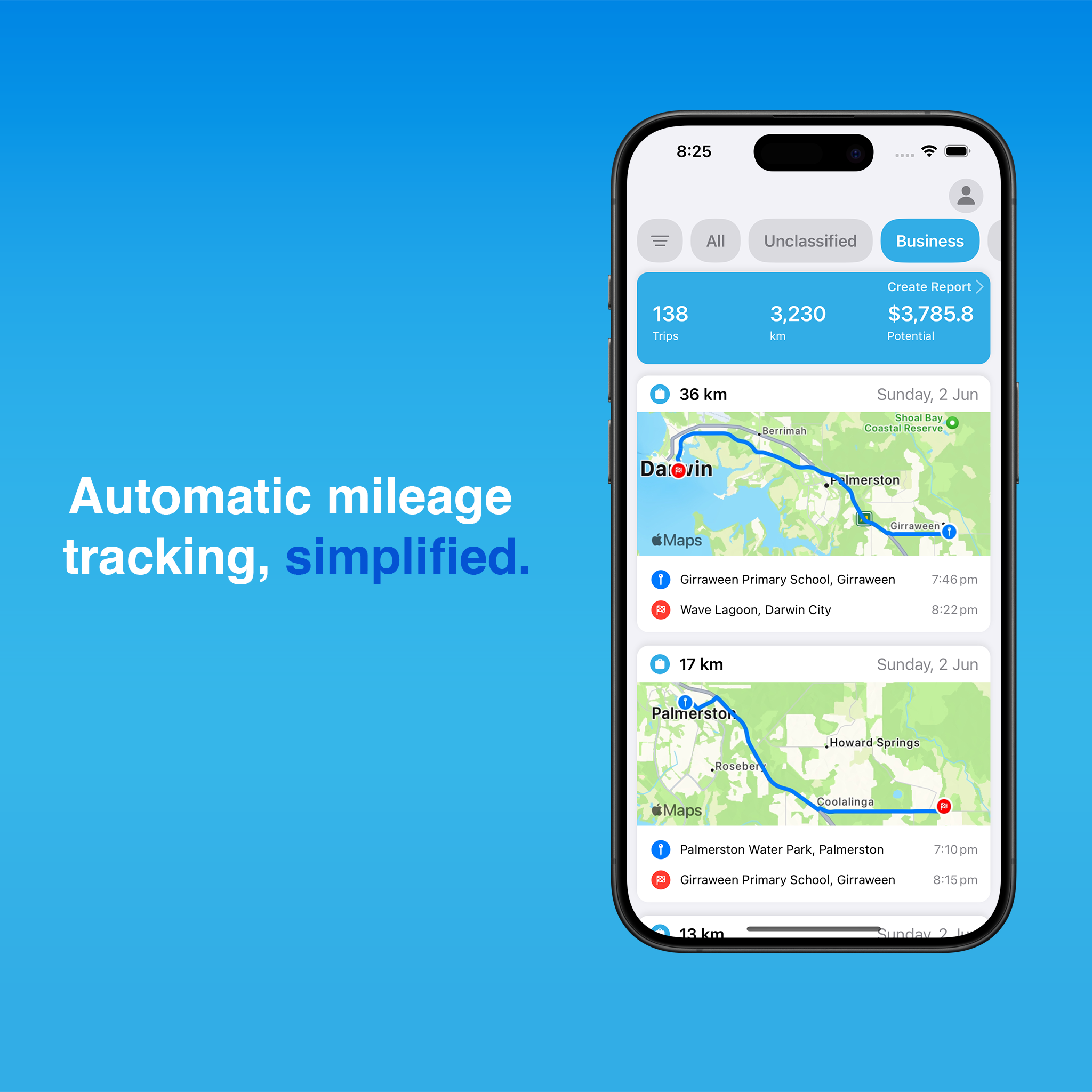

Streamlining your claims with technology

While calculating reimbursements using the cents per km method is straightforward, maintaining a compliant mileage log can often be cumbersome. To alleviate this challenge, consider adopting an ATO-compliant logbook app. Such apps are designed to effortlessly track your kilometers, ensuring you never miss logging a trip.

Understanding ATO Mileage Rates

The ATO plays a crucial role in the Australian taxation system, setting guidelines and rates for various tax-related matters, including mileage deductions. The mileage rate, or cents per kilometre rate, is designed to simplify the process of claiming vehicle-related expenses for business purposes. This method provides a straightforward way to calculate deductions without the need for detailed expense records.

What is the Cents Per Kilometre Method?

The cents per kilometre method allows taxpayers to claim a set rate per kilometre for business travel. This method is beneficial because it simplifies the record-keeping process, requiring only a logbook of business travel distances rather than detailed receipts for each expense. However, it also has limitations, such as a cap on the number of kilometres that can be claimed.

ATO Mileage Rate 2024-2025 Overview

The ATO’s 88 cents per kilometre rate for the 2024-2025 fiscal year, up from 85 cents in the previous year. This increase accounts for rising vehicle operating costs. The new rate is effective from July 1, 2024, and is intended to help taxpayers more accurately reflect the actual costs of using their vehicles for business purposes.

Comparing Previous Years’ Rates

Comparing the new rate with previous years shows a trend of gradual increases. The 2023-2024 rate was 85 cents per kilometre, reflecting a consistent adjustment to keep pace with inflation and rising vehicle costs. This historical context helps taxpayers understand the rationale behind the rate changes.

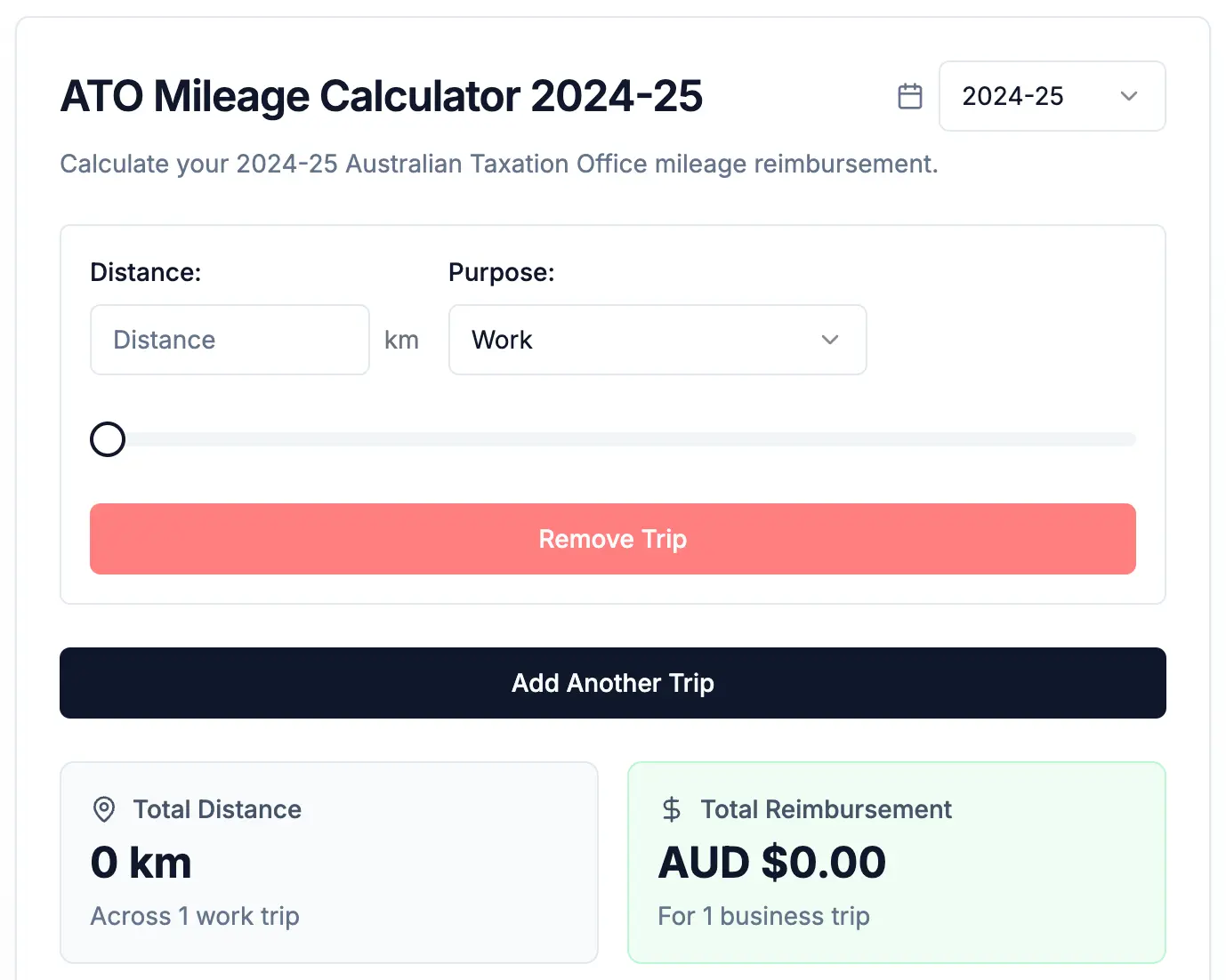

Calculating Your Mileage Deduction

Calculating your mileage deduction using the cents per kilometre method is straightforward. Multiply the total business kilometres driven by the ATO rate for the applicable year. For example, if you drove 1,000 business kilometres in 2024-2025, your deduction would be 1,000 km x 0.88 = $880.

Who Can Use the Cents Per Kilometre Method?

Eligibility for the cents per kilometre method includes individuals and businesses using vehicles for work-related travel. Common scenarios include sales professionals, tradespeople, and small business owners who frequently travel for client meetings or service calls.

Record-Keeping Requirements

Accurate record-keeping is essential for claiming mileage deductions. Maintain a detailed logbook that includes dates, distances, and purposes of trips. This documentation is crucial for substantiating your claims and ensuring compliance with ATO guidelines.

Maximizing Your Mileage Claim

To maximize your mileage claim, ensure you log all eligible business travel, avoid mixing personal and business use in your records, and stay updated with ATO announcements and changes. Utilize mileage tracking apps to simplify the process and maintain accurate records.

Common Mistakes to Avoid

Avoid common mistakes such as overestimating distances, neglecting to log trips, and claiming personal travel. Ensuring accurate and honest reporting will prevent issues with the ATO and potential penalties.

Impact on Businesses

For businesses, the cents per kilometre method provides a predictable way to budget for vehicle expenses. Small businesses can benefit from simplified record-keeping, while large corporations can integrate the rate into their expense management systems.

Tax Implications

Using the cents per kilometre method has significant tax implications. Properly claimed, it reduces taxable income, resulting in lower tax liabilities. Ensure you understand the reporting requirements to avoid issues during tax time.

Fuel Costs and the Mileage Rate

The mileage rate reflects current fuel costs, which can fluctuate significantly. Monitoring fuel price trends can help predict future adjustments to the rate and allow for better financial planning.

Maintenance and Depreciation Costs

Vehicle maintenance and depreciation are factored into the mileage rate. Regular maintenance and understanding depreciation schedules can help you make informed decisions about vehicle use and replacement.

Environmental Considerations

The mileage rate also considers environmental factors, encouraging more efficient vehicle use. Eco-friendly driving practices not only reduce operating costs but also support broader environmental goals.

Future Predictions for Mileage Rates

Predicting future mileage rates involves considering economic trends, fuel prices, and inflation. Expert insights suggest gradual increases in line with rising costs, ensuring the rate remains fair and reflective of actual expenses.

Expert Opinions on the New Rate

Financial analysts and tax professionals view the new 88 cents per kilometre rate as a necessary adjustment. It aligns with current economic conditions and ensures taxpayers can accurately claim their vehicle expenses.

Comparative Analysis with International Rates

Comparing the ATO rate with international rates reveals interesting insights. For instance, the US standard mileage rate is currently 58.5 cents per mile (approx. 36.4 cents per km), and the UK rate is 45 pence per mile (approx. 29 pence per km), highlighting different approaches to mileage deductions.

Frequently Asked Questions

How is the ATO mileage rate determined?

The rate is based on vehicle operating costs, including fuel, maintenance, and depreciation, reviewed annually by the ATO.

Can I switch between the cents per kilometre method and actual expense method?

Yes, but you must choose one method for the entire tax year and cannot switch back and forth within the same year.

What if I drive more than the maximum allowable kilometres?

You must use the actual expenses method for any travel exceeding the maximum kilometres allowed under the cents per kilometre method.

Do I need to keep receipts for fuel and maintenance?

No, if you use the cents per kilometre method, detailed receipts are not required, but a logbook of travel distances is essential.