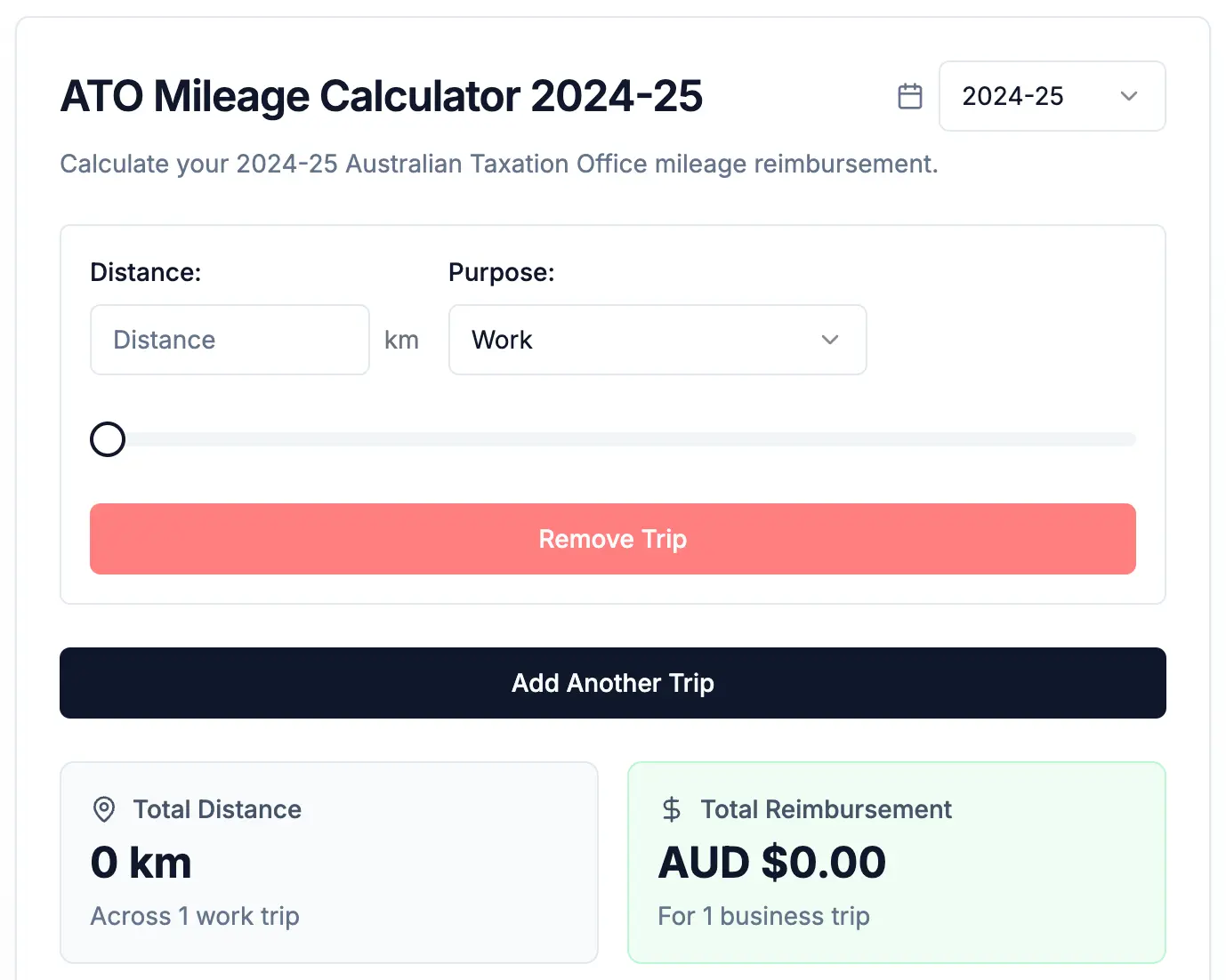

ATO cents per km calculator 2024-2025

Navigating tax deductions can be complex, especially for those who travel frequently for work. Understanding the value of each kilometre can significantly impact your tax returns. The Australian Taxation Office (ATO) offers a cents per kilometre method, making it simpler for individuals to calculate their vehicle expenses for income-producing purposes. As of 2024, staying updated with the latest rates and how to utilize them effectively is more important than ever.

Cents per km limit limitations

Using the cents per km method allows you to claim up to 5,000 kilometers per vehicle, per year. If your work-related travel exceeds this threshold, we recommend switching to the logbook method. This method does not have an upper limit and could maximise your tax deductions by accommodating more extensive travel records.

Streamlining your claims with technology

While calculating reimbursements using the cents per km method is straightforward, maintaining a compliant mileage log can often be cumbersome. To alleviate this challenge, consider adopting an ATO-compliant logbook app. Such apps are designed to effortlessly track your kilometers with your iPhone, ensuring you never miss logging a trip. They enable you to generate ATO-compliant reports in both PDF and Excel formats, which can be easily shared with your employer or accountant. This modern approach saves you significant time and effort compared to traditional vehicle logbook methods.