Product

IRS Mileage Rate 2026: Complete Tax Deduction Guide + Calculator

November 21, 2025 • 13 min read

Status: The IRS announced the 2026 standard mileage rates on December 22, 2025 (News Release IR-2025-128), effective January 1, 2026. The official rates are 72.5 cents per mile for business, 20.5 cents per mile for medical/moving, and 14 cents per mile for charitable driving (fixed by law).

Quick Answer: IRS Federal Mileage Rate 2026

The IRS announced the 2026 standard mileage rates on December 22, 2025, and they took effect January 1, 2026. The official rates are 72.5 cents per mile for business, 20.5 cents per mile for medical/moving, and 14 cents per mile for charitable driving. If you searched for "IRS mileage rate 2026 calculator" or "IRS mileage log requirements 2026," use the formula and checklist below.

- Business: 72.5 cents/mile (official; up 2.5 cents from 2025)

- Medical/Moving: 20.5 cents/mile (official; down 0.5 cents from 2025)

- Charitable: 14 cents/mile (fixed by law)

Calculate Your 2026 Deduction → — enter your estimated business miles and instantly see your potential 2026 mileage deduction.

Announcement Timing (2026)

- Announcement date: December 22, 2025 (IR-2025-128)

- Effective date: January 1, 2026

- Technical reference: IRS Notice 2026-10

On This Page

- 2026 IRS mileage rates overview

- How to calculate your 2026 deduction (calculator)

- Who qualifies for mileage deductions

- IRS mileage log requirements 2026

- IRS mileage rate history

- Mileage FAQs and edge cases

If you drive for work in Canada instead of the United States, read our separate guide to the 2026 CRA mileage rate and prescribed per-kilometre automobile allowance.

What Is the IRS Mileage Rate for 2026?

The IRS standard mileage rate is the amount per mile taxpayers can deduct when calculating vehicle-related tax deductions. Updated annually, the 2026 mileage rate allows you to deduct costs of operating a vehicle for business, charitable, medical, or moving purposes. Using the standard mileage deduction simplifies your taxes by eliminating the need to track actual vehicle expenses like gas, maintenance, insurance, and depreciation.

2026 Standard Mileage Rates (Official)

| Purpose | 2026 Rate | 2025 Rate | Change |

|---|---|---|---|

| Business | 72.5 cents/mile (official) | 70 cents/mile | Up 2.5 cents |

| Medical/Moving* | 20.5 cents/mile (official) | 21 cents/mile | Down 0.5 cents |

| Charitable | 14 cents/mile (fixed by law) | 14 cents/mile | No change |

*Moving expense deductions are generally limited to active-duty Armed Forces members on qualifying orders and certain Intelligence Community officers/employees under federal law.

Official IRS Source Details (Reference)

The IRS announced the 2026 rates on December 22, 2025 (News Release IR-2025-128), with technical details in Notice 2026-10. Key details:

- Business rate: 72.5 cents per mile (up 2.5 cents from 2025)

- Medical/Moving rate: 20.5 cents per mile

- Charitable rate: 14 cents per mile (fixed by law)

- Effective date: January 1, 2026

- Sources: IRS News Release IR-2025-128 and Notice 2026-10

- Who It Affects: Self-employed individuals, contractors, gig workers, and business owners claiming mileage deductions for 2026

How to Calculate Mileage for Taxes in 2026 (Calculator)

Calculating your mileage deduction for 2026 is straightforward with the standard mileage rate method. It comes down to a simple formula.

Basic Calculation Formula

Total Deduction = Business Miles Driven × IRS Standard RateIRS Mileage Rate 2026 Calculator Steps

- Add your total 2026 business miles.

- Multiply by $0.725 (72.5 cents).

- Keep your trip log and supporting records for your tax file.

If you searched for an "IRS mileage rate 2026 calculator," this formula is exactly what calculators use behind the scenes.

- 5,000 business miles × $0.725 = $3,625 deduction

- 12,000 business miles × $0.725 = $8,700 deduction

How Do You Figure Mileage for Taxes in 2026?

To figure your mileage for taxes, add up all of your qualifying business miles for the year and multiply that total by the official IRS mileage rate for 2026 (72.5 cents per mile for business). The result is your total 2026 mileage deduction using the standard mileage method.

Real-World Example

Sarah, a real estate agent, drives for business purposes:

- Total miles driven in 2026: 15,000 miles

- Business miles: 12,000 miles

- Personal miles: 3,000 miles

- 2026 business rate for this example: 72.5 cents per mile (official IRS rate)

Sarah's Deduction: 12,000 × $0.725 = $8,700

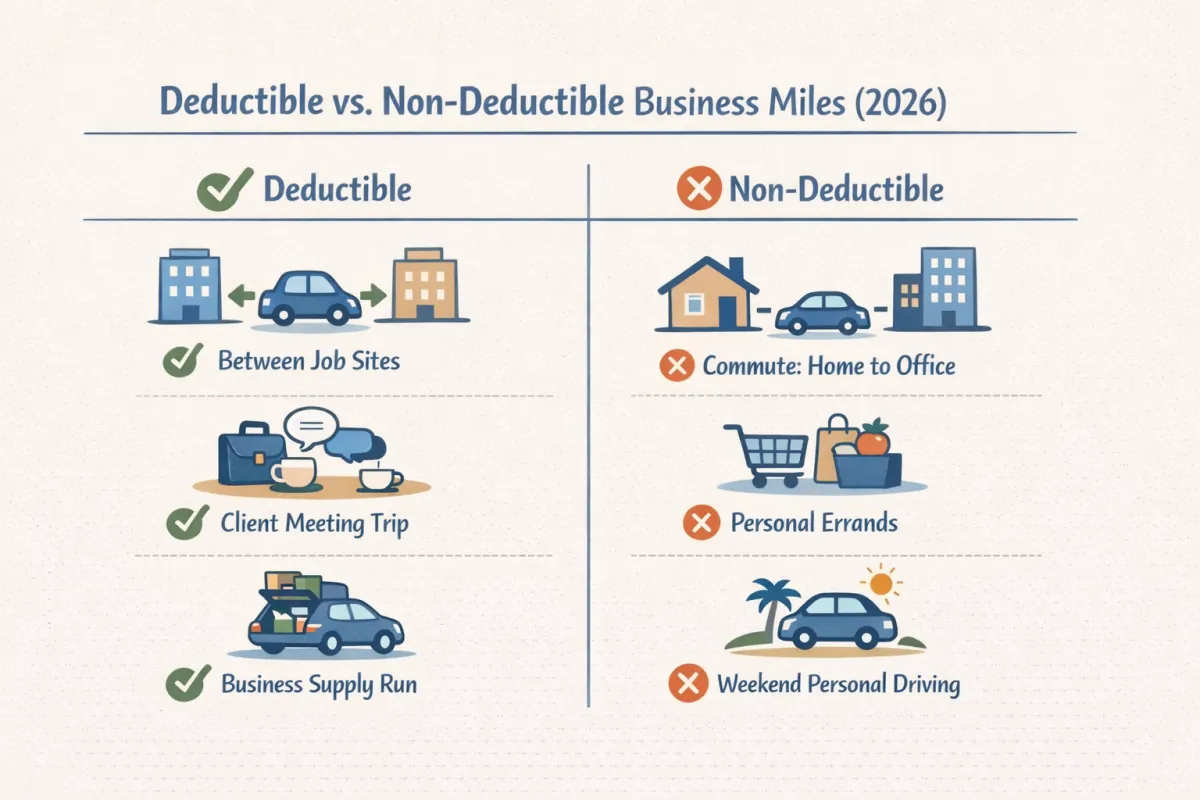

What Counts as Business Mileage?

Deductible Business Mileage Includes:

- Driving between work locations

- Meeting with clients or customers

- Business errands (bank, post office, supplies)

- Travel to conferences or training

- Driving to temporary work locations

NOT Deductible:

- Commuting from home to regular workplace

- Personal errands during business trips

- Weekend personal use of business vehicle

Who Qualifies for the 2026 IRS Mileage Deduction?

Not everyone can claim the IRS mileage deduction. Here's who qualifies for 2026 mileage tax deductions and common misconceptions:

Eligible Taxpayers

Self-Employed & Business Owners

- Sole proprietors

- LLC members

- S-Corp owners

- Partnership partners

- Independent contractors

Gig Economy Workers

- Uber/Lyft drivers

- DoorDash/Instacart shoppers

- Amazon Flex drivers

- TaskRabbit taskers

- Freelance professionals

For more on how the IRS treats gig work, see the IRS Gig Economy Tax Center.

Specific Professionals

- Real estate agents

- Outside sales representatives

- Consultants

- Home healthcare providers

- Traveling nurses

Other Eligible Groups

- Active-duty military (moving expenses)

- Volunteers for qualified charities

- Medical appointment travel (with limitations; see IRS Publication 502)

Real-World Examples by Profession

- Rideshare and delivery drivers (Uber, Lyft, DoorDash, Instacart) – frequent trips between pickups, dropoffs, and hotspots.

- Real estate agents – showings, open houses, client meetings, and property inspections.

- Field-service providers (plumbers, electricians, HVAC, IT consultants) – driving between customer locations throughout the day.

- Home healthcare providers and traveling nurses – visits to patients' homes and medical facilities.

- Sales reps and consultants – traveling to client sites, conferences, and offsite meetings.

2026 Mileage Deductions for Uber & Delivery Drivers

If you drive for Uber, Lyft, DoorDash, Instacart, Amazon Flex, or other gig platforms, the 2026 mileage rate will likely be one of your biggest tax deductions. In general, you can deduct miles that are directly tied to accepting and completing gigs:

- Driving to your first pickup after going online in the app

- Miles between pickups and dropoffs, including "deadhead" miles

- Trips to purchase supplies directly related to driving (phone mounts, chargers, delivery bags)

Not Deductible: commuting to a non-gig job, purely personal errands, or detours for personal reasons.

Because gig drivers often rack up tens of thousands of miles per year, using an automatic tracker like DriveLog helps ensure every eligible mile is captured and categorized correctly in case of an audit.

2026 Mileage Deductions for Contractors & Trades

Contractors and tradespeople—like plumbers, electricians, HVAC technicians, landscapers, and general contractors— can usually deduct miles driven between job sites, to suppliers, and to client meetings.

- Driving between multiple job sites in a single day

- Trips to suppliers, warehouses, and hardware stores for materials

- Travel to estimates, inspections, or permitting offices

Generally Not Deductible: commuting from home to a single, long-term job site that functions as your regular workplace or personal errands unrelated to your business.

Automatic tracking with DriveLog makes it easier to separate business and personal trips and generate mileage logs that align with IRS requirements, simplifying year-end bookkeeping.

Who Cannot Claim Mileage Deductions?

W-2 Employees (Post-2017 Tax Reform)

- Regular employees can no longer deduct unreimbursed business mileage

- Exception: Certain qualified employees (armed forces reservists, qualified performing artists)

Important: If your employer reimburses you at a rate lower than the IRS standard rate, you cannot deduct the difference.

IRS Mileage Log Requirements 2026: How to Track Mileage for Taxes

Proper mileage tracking is essential for IRS compliance and maximizing your 2026 tax deductions. If you're wondering how to track mileage for taxes, the IRS expects you to maintain a complete and accurate mileage log.

For a practical setup workflow, follow this step-by-step guide to track business mileage on iPhone .

IRS Mileage Log Requirements 2026 (What to Record)

The IRS requires "adequate records" or "sufficient evidence" to support your deduction. Your mileage log must include:

- Date of each trip

- Starting location

- Destination

- Business purpose

- Odometer readings (beginning and end of trip)

- Total miles driven

Is There a Maximum Number of Miles You Can Deduct in 2026?

There is no fixed IRS cap on business miles under the standard mileage method. The practical limit is documentation quality: your miles must be business-related, reasonable for your work, and supported by contemporaneous records.

In other words, high-mileage claims are allowed, but they are more likely to be questioned if your log is incomplete or inconsistent.

Common Tracking Mistakes to Avoid

- Reconstructing logs at year-end — IRS can reject estimated logs

- Round numbers — Suspicious patterns like exactly 100 miles weekly

- Missing documentation — No supporting evidence for business purposes

- 100% business use — Unrealistic unless vehicle is exclusively for business

- Inconsistent methods — Switching between tracking methods

Pro Tips for Maximizing Deductions

- Track everything, categorize later — Better to have too much data

- Photo receipts — Photograph gas receipts for additional documentation

- Calendar integration — Link trips to calendar appointments

- Regular reviews — Weekly review ensures accuracy

- Separate vehicles — If possible, dedicate one vehicle to business

How Do You Prove Mileage to the IRS?

If you're concerned about how to document mileage for taxes or how do you prove mileage to the IRS, detailed records are your best protection. Keep:

- A contemporaneous mileage log (paper or app-based)

- Notes on the business purpose of each trip

- Supporting documents like calendars, client invoices, and receipts

Using an IRS-compliant mileage tracking app like DriveLog makes it much easier to document and prove your mileage if you are ever audited.

If you need a quick estimate first, use the IRS mileage calculator and then keep records that support the final deduction you claim.

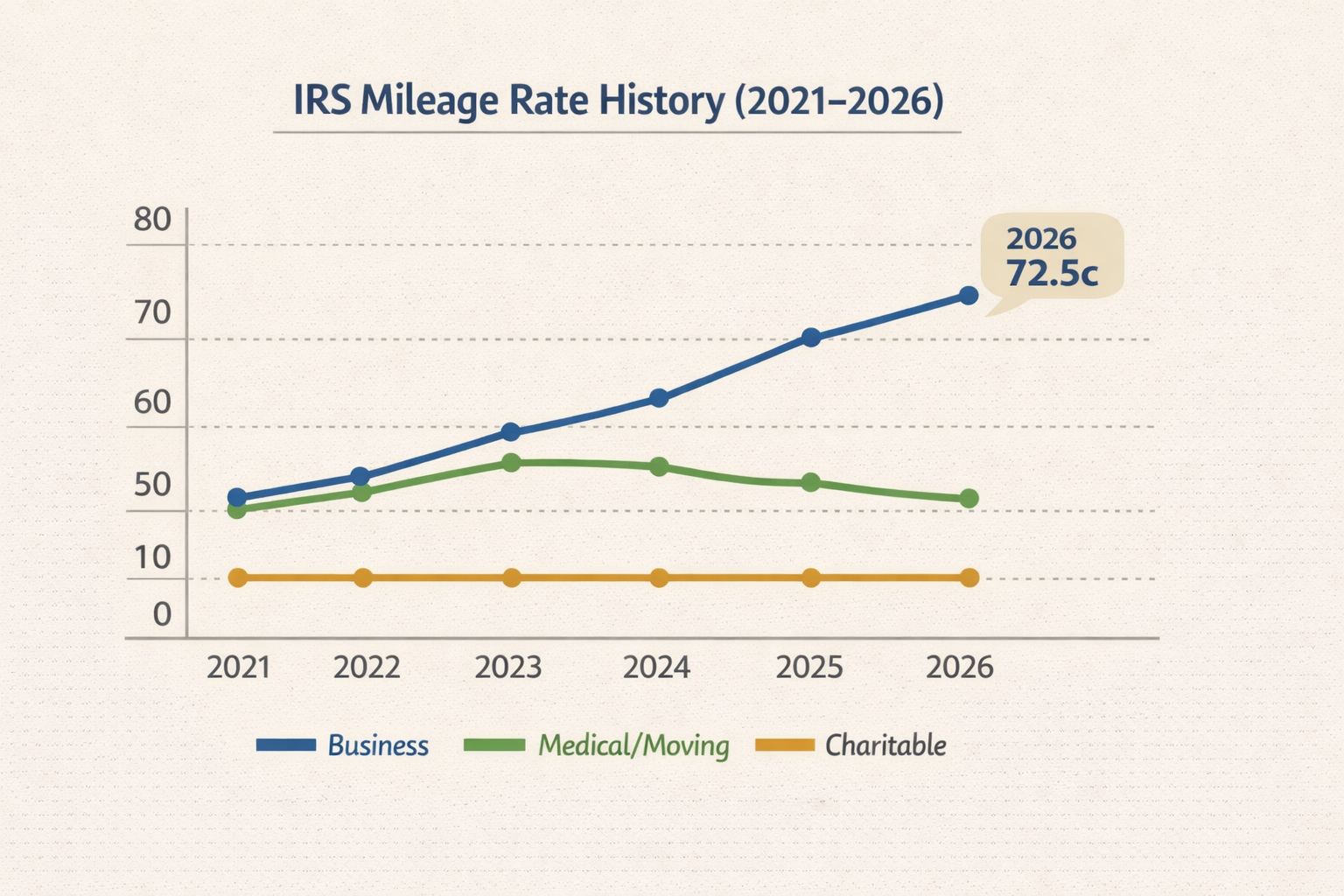

IRS Mileage Rate History: Understanding the Trends

Understanding historical rate trends helps predict future changes and maximize your deductions. Here's how rates have evolved:

5-Year Rate History (2021–2025)

| Year | Business | Medical/Moving | Charitable |

|---|---|---|---|

| 2025 | 70¢ | 21¢ | 14¢ |

| 2024 | 67.0¢ | 21¢ | 14¢ |

| 2023 | 65.5¢ | 22¢ | 14¢ |

| 2022 | 58.5¢/62.5¢* | 18¢/22¢* | 14¢ |

| 2021 | 56.0¢ | 16¢ | 14¢ |

*Mid-year adjustment in 2022 due to gas price increases

What Influences Rate Changes?

The IRS considers several factors when setting annual mileage rates:

- Fuel Prices: Primary driver of rate changes

- Vehicle Depreciation: Average decline in vehicle values

- Insurance Costs: Commercial and personal auto insurance trends

- Maintenance Expenses: Parts, labor, and service costs

- General Inflation: Overall economic price increases

Frequently Asked Questions: IRS Mileage Rate 2026 & Tax Deductions

How do you figure out mileage for taxes?

To figure out mileage for taxes, add up all of your qualifying business miles for the year and multiply that total by the IRS mileage rate for 2026 (72.5 cents per mile for business). This gives you your standard mileage deduction for 2026.

Is there an IRS mileage rate 2026 calculator?

Yes. Multiply your 2026 business miles by $0.725 to estimate your standard mileage deduction, or use a calculator tool to do the math quickly. Keep supporting mileage records for tax filing.

What are IRS mileage log requirements for 2026?

Your log should include the date, start and destination locations, business purpose, odometer start/end (or equivalent mileage evidence), and total business miles. Supporting records like calendars and invoices should match the trips you claim.

When do the 2026 mileage rates take effect?

The 2026 rates take effect January 1, 2026, and apply to all miles driven during the calendar year, regardless of when you file your taxes.

When was the 2026 IRS mileage rate announced?

The IRS announced the 2026 rates on December 22, 2025 (News Release IR-2025-128). Those rates apply to miles driven on and after January 1, 2026.

Can I use different methods for different vehicles?

Yes, if you have multiple vehicles used for business, you can use the standard mileage rate for one and actual expenses for another. However, you must be consistent for each vehicle.

What if I forgot to track some business miles?

While the IRS requires contemporaneous records, you can reconstruct a log using supporting documentation like calendars, emails, and receipts. However, this is risky and may not withstand an audit.

How does mileage reimbursement from my employer affect my deduction?

If your employer reimburses you at the IRS standard rate, you cannot claim an additional deduction. If they reimburse at a lower rate and you're eligible for deductions, you may only be able to claim the difference in certain circumstances.

Do I need to keep paper records?

No. Electronic records are acceptable to the IRS if they are complete and accurate. Apps like DriveLog can make ongoing recordkeeping easier.

Can I deduct mileage for my commute if I work from home sometimes?

Regular commuting is never deductible, even if you work from home some days. However, if your home is your principal place of business, trips to client locations are deductible.

What happens if I'm audited?

If you've maintained accurate, contemporaneous records with a tool like DriveLog, you'll be well-prepared. The app generates IRS-compliant reports that include all required information.

Can gig workers deduct miles between apps?

Yes, if you drive for multiple gig economy platforms, miles driven between different app assignments (like from an Uber dropoff to a DoorDash pickup) are deductible business miles.

How long should I keep mileage records?

Keep mileage logs for at least 3 years from the date you file your tax return. If you claim a loss, keep records for 7 years.

Is there a limit to how many miles I can deduct?

There's no IRS limit on mileage deductions, but excessive mileage might trigger scrutiny. Ensure your mileage is reasonable for your business type and backed by documentation.

Additional Resources

- IRS News Release IR-2025-128 - 2026 standard mileage rates announcement

- Notice 2026-10 - official notice with 2026 business, medical/moving, and fixed/variable rate details

- IRS Publication 463 - Travel, Entertainment, Gift, and Car Expenses

- IRS Publication 502 - Medical and Dental Expenses

- Topic 510 - Business Use of Car

Disclaimer: This article provides general information about IRS mileage rates and deductions. It is not tax advice. Consult with a qualified tax professional for advice specific to your situation.

Last Updated: February 14, 2026 (verified against IRS News

Release IR-2025-128 and Notice 2026-10)

Next Update: Recheck if the IRS publishes revised mileage

guidance or related deduction-rule changes