Product

How to Track Your Mileage as a Delivery Driver Using AI

November 13, 2024 • 3 min read

As a delivery driver, tracking your mileage accurately can mean the difference between losing money and maximizing your tax deductions. With new AI-powered app solutions like DriveLog, you can finally say goodbye to manual logging and focus on what matters most – delivering and earning income.

![]()

The Challenge: Why Delivery Drivers Struggle with Mileage Tracking

If you’re a delivery driver for companies like DoorDash, Uber Eats, Amazon Flex, or running your own delivery business, you know the hassles:

- Multiple short trips throughout the day

- Mixing personal and business drives

- Forgetting to log trips during busy periods

- Manually classifying hundreds of trips a day

- Lost receipts and incomplete records

- Hours spent organizing receipts for tax time

The Solution: AI-Powered Mileage Tracking with DriveLog

DriveLog uses advanced artificial intelligence (AI) to solve these common challenges. Here’s how our iOS app makes mileage tracking effortless for delivery drivers:

1. Automatic Trip Detection

- No need to press start/stop

- Runs quietly in the background

- Battery-efficient GPS tracking

- Never miss a deductible mile

2. Smart Business/Personal Trip Classification: Save Hours with AI-Powered Automation

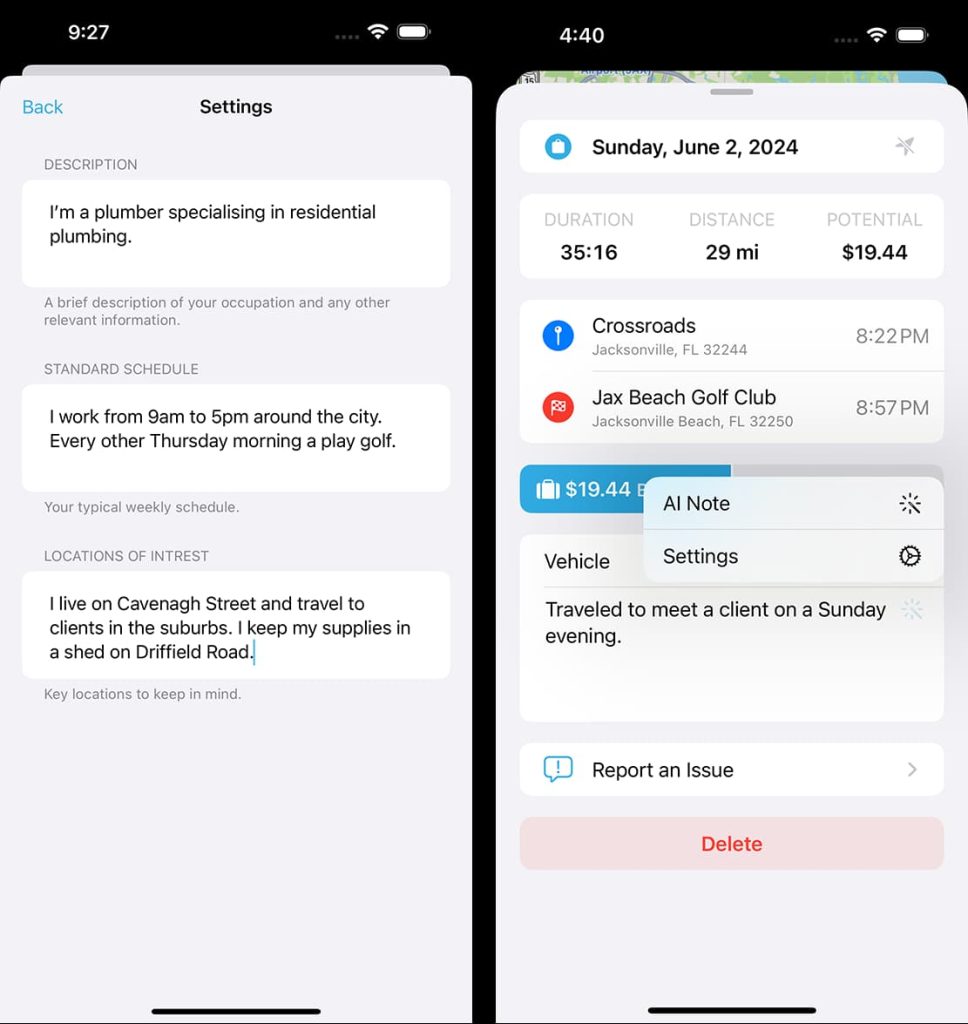

Say goodbye to manually classifying trips. With DriveLog’s Smart Classify feature, you can automate the organization of your business and personal travel using intelligent scheduling rules. Set your vehicle usage by day, specify your work hours, and designate personal travel times—all helping you save countless hours.

Here’s how Smart Classify enhances your mileage tracking:

- Instantly categorize thousands of trips at once using Smart Classify

- Create custom schedules for different vehicles

- Set specific work hours to auto-classify business trips

- Define personal travel times for accurate tracking

- Apply rules across your entire mileage logbook instantly

For example, if you drive for DoorDash every Monday and Wednesday from 9 AM to 5 PM, DriveLog can automatically classify those trips as business miles. Running personal errands on weekends? Smart Classify tags those automatically too. It even adapts to different vehicles on different days.

3. AI-Generated Trip Notes

Our innovative AI Trip Note feature automatically generates detailed, customized trip notes based on your preferences, helping you keep track of trip purposes—a key advantage come tax time. Tailor notes to your specific needs, like frequently visited locations, personal stops (e.g., a favorite lunch spot), or regular routines. Whether you’re golfing every Thursday morning or picking up the kids in the city on Fridays, AI Trip Note captures these patterns seamlessly, making your mileage log more accurate and personalized.

It’s like magic! Download the app and give it a try. Trip notes make staying organized at tax time a breeze.

Step-by-Step: Getting Started with DriveLog

Full guide is available here, short version is:

- Download and Install

- Get DriveLog from the iOS App Store

- Quick setup process

- No sign up required. Your data saves securely to your iCloud account.

- Let AI Do the Work

- Drive normally

- DriveLog detects movement automatically

- AI classifies your trips

- Smart notes are generated automatically

- Review and Organize

- Check trip classifications

- Confirm AI-generated notes

- Make any needed adjustments

- Export reports anytime

Maximizing Tax Deductions as a Delivery Driver

With DriveLog’s AI features, you can:

- Track every deductible mile

- Separate personal from business use

- Generate detailed reports for tax time

- Keep tax compliant records

- Calculate potential deductions in real-time

Real Numbers: See the Difference

Consider this example:

- Average delivery driver: 120 miles per day

- Current IRS rate: 67¢ per mile (2024)

- Potential daily deduction: $80.40

- Monthly deduction: $1,608 (based on 5 day working week)

- Annual deduction: $19,296

Missing even 10% of your miles could cost you $2,829 in tax deductions! Your mileage might vary, so use out free calculator tool to estimate your deductions:

Why Delivery Drivers Choose DriveLog

- Save Hours of Admin time

- No manual logging

- Automatic smart trip classification

- AI-generated notes

- Quick report generation

- Get Every Deduction Dollar You Deserve

- Complete mileage records

- Accurate trip classification

- Detailed documentation

- Tax compliant reports

- Stress Less with Automatic, Secure Mileage Logs

- Automatic backup

- Secure cloud storage

- Audit-ready records

- Professional reports

Tips for Success

- Review trips weekly or fortnightly

- Export monthly reports for your records

- Save backup copies of annual reports

Start Tracking Smarter Today with AI

Don’t let manual mileage logging eat into your valuable time and earnings. Download DriveLog today and experience the ultimate AI-driven mileage tracking app designed specifically for delivery drivers.

DriveLog: The smart choice for delivery drivers who want an accurate, automatic mileage tracking app with AI-powered features.