Product

DriveLog: The Ultimate AI-Powered Mileage Tracking Solution for Businesses in 2024

October 30, 2024 • 3 min read

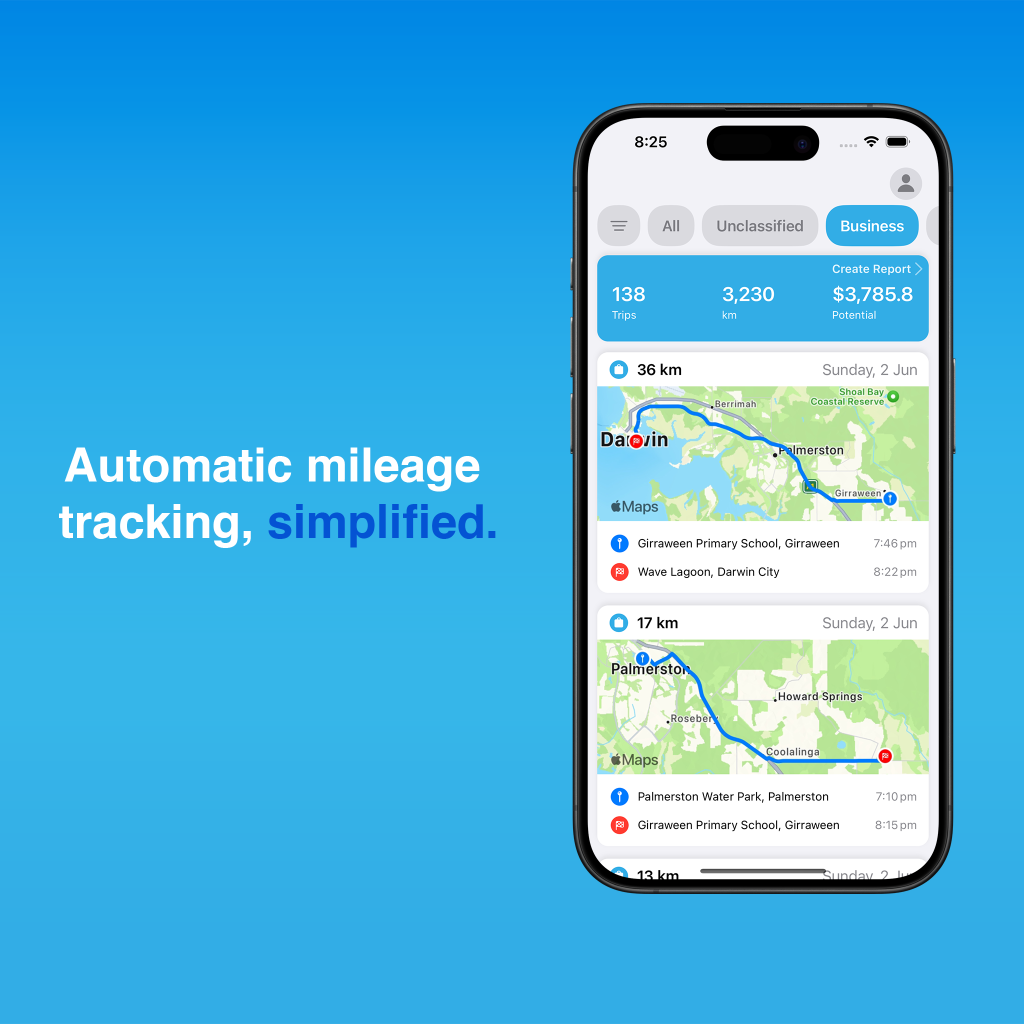

In today’s fast-paced business world, managing travel expenses can be a daunting task. Traditional mileage tracking methods often lead to inaccurate records, missed deductions, and hours of manual work. But what if there was a smarter way? Enter DriveLog – the revolutionary AI-powered mileage tracking app that’s transforming business travel expense management in 2024.

![]()

The Challenges of Traditional Mileage Tracking

Businesses and professionals have long struggled with the inefficiencies of manual mileage tracking:

- Forgetting to log trips, resulting in lost deductions

- Spending hours on tedious spreadsheet management

- Inaccurate distance calculations leading to discrepancies

- Preparing tax documentation becomes a time-consuming nightmare

- Missing out on potential tax benefits due to incomplete records

DriveLog’s AI-powered solution eliminates these headaches, making mileage tracking a breeze.

How DriveLog’s AI Technology is Changing the Game

DriveLog’s cutting-edge AI algorithms work tirelessly in the background to simplify your mileage tracking experience:

1. Seamless Automatic Trip Detection

DriveLog detects trip start and end points automatically, calculating precise distances using advanced GPS technology. The AI algorithms differentiate between various modes of transportation and create detailed route documentation for each trip.

2. Smart Trip Classification

DriveLog’s AI learns your travel patterns, auto-categorizing business vs. personal trips and remembering frequent destinations. The app suggests trip purposes based on your history, applies your preferences automatically, and documents trip notes for tax purposes.

3. Intelligent Tax Optimization

DriveLog identifies potential deductions automatically and applies current IRS, CRA, ATO, and HMRC mileage rates. The app flags patterns that might trigger audits and generates audit-ready reports instantly, ensuring your business remains tax compliant.

Real Results: How DriveLog is Transforming Business Travel

Don’t just take our word for it – here’s what DriveLog users are saying:

“DriveLog has been a game-changer for our business. We’ve saved countless hours on mileage tracking and our expense reports are more accurate than ever.” – Sarah, Small Business Owner.

“I used to dread tax season, but with DriveLog, I have peace of mind knowing that my mileage records are complete and compliant.” – Michael, independent electrician.

![]()

With DriveLog, users experience:

- 95% reduction in time spent on mileage logging

- 30+ hours saved annually on manual tracking

- 100% accurate trip recording

- Complete compliance with IRS, CRA, ATO, and HMRC requirements

Getting Started with DriveLog

Making the switch to DriveLog is simple:

- Download DriveLog from the Apple App Store

- Enable automatic tracking

- Let AI handle the rest

Need setup instructions first? Start with our guide to track mileage on iPhone.

DriveLog adapts to your needs with customizable business rules, multiple vehicle profiles, and flexible reporting options. Plus, with enterprise-grade data protection, you can trust that your sensitive information is secure.

Why Choose DriveLog?

Intelligent Automation: Our AI handles the heavy lifting

Time Savings: No more manual logging

Accuracy: Every mile captured precisely

Tax Compliance: IRS, CRA, ATO, and HMRC ready reports

User-Friendly: Set it and forget it

Secure: Your data is protected with industry-leading security measures

Experience the Future of Mileage Tracking

In the era of digital transformation, DriveLog is leading the charge in AI-powered mileage tracking solutions. By combining innovative technology with a user-centric design, we’re making business travel expense management simpler and smarter than ever before.

Ready to revolutionize your mileage tracking? Download DriveLog today and join the thousands of businesses already benefiting from our AI-powered solution.

FAQ

1. Is DriveLog compatible with my device?

DriveLog is available for iOS devices and can be downloaded from the Apple App Store.

2. How does DriveLog ensure the accuracy of mileage tracking?

DriveLog uses advanced GPS technology and AI algorithms to precisely calculate distances and detect trip start and end points automatically.

3. Can I customize DriveLog to suit my business needs?

Yes, DriveLog offers customizable business rules, multiple vehicle profiles, and flexible reporting options to adapt to your specific requirements.

4. Is my data secure with DriveLog?

Absolutely. DriveLog employs enterprise-grade data protection measures to ensure the security of your sensitive business information.

5. How does DriveLog help with tax compliance?

DriveLog automatically applies current IRS, CRA, ATO, and HMRC mileage rates, identifies potential deductions, and generates audit-ready reports, ensuring your business remains tax compliant.