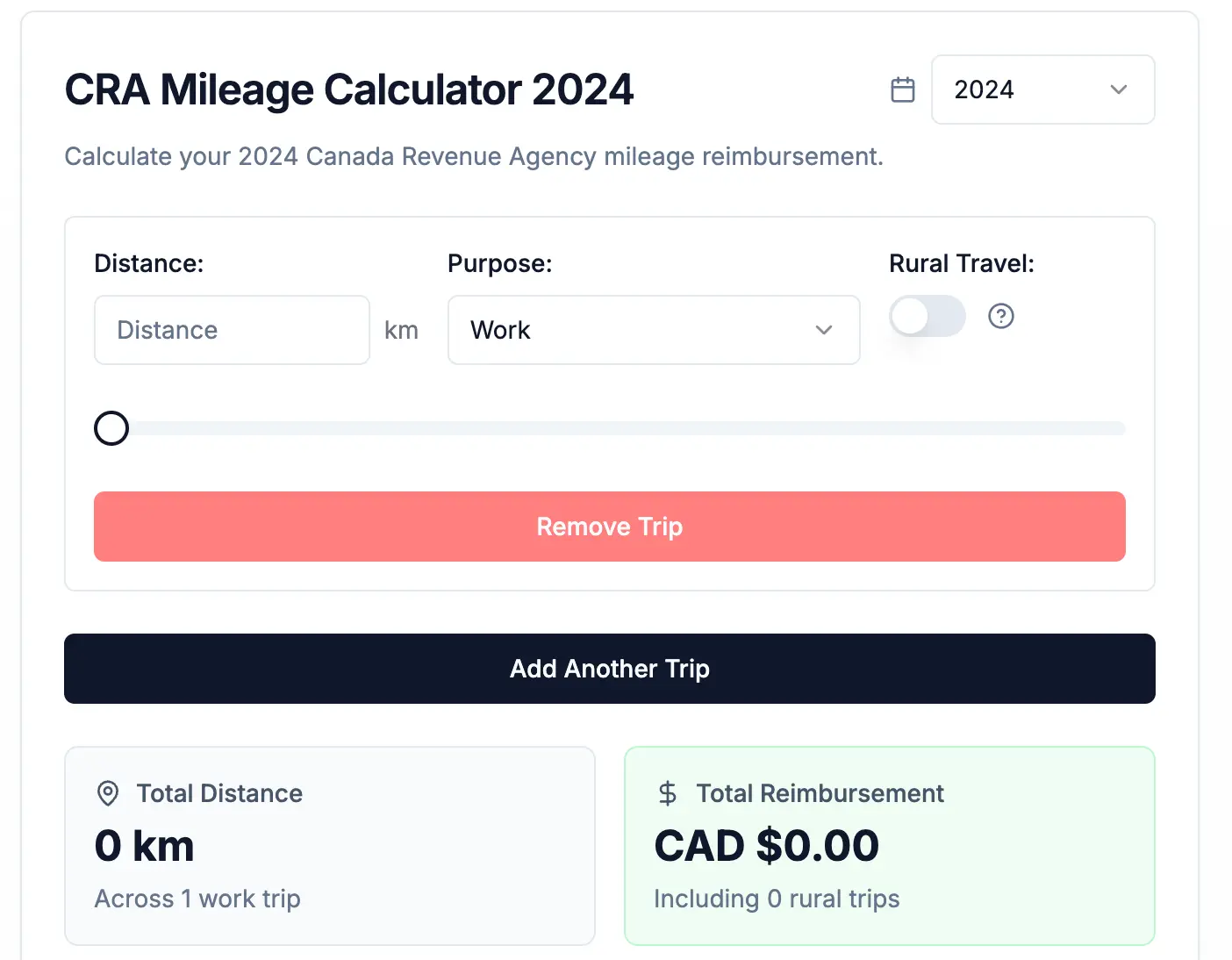

Easily estimate your potential reimbursement for work-related driving using the CRA’s official 2024 mileage rates. Enter your business kilometres into the calculator below to see how much you can claim.

How to Calculate the 2024 CRA Mileage Allowance in Canada

Calculating your mileage allowance for 2024 based on CRA’s rates is straightforward. The CRA sets annual per-kilometre rates that you can use to estimate your reimbursement for business-related driving. Here’s a simple step-by-step guide to help you calculate your mileage allowance:

Track Your Business Kilometres:

First, you need to know how many kilometres you’ve driven for work purposes. Be sure to keep an accurate mileage log that records each trip’s date, destination, purpose, and distance.

![]()

Apply the CRA Mileage Rates for 2024:

The CRA mileage allowance rates for 2024 are:

- 70 cents per kilometre for the first 5,000 kilometres driven for business.

- 64 cents per kilometre for any distance beyond 5,000 kilometres.

- Additional 4c per km for Northwest Territories, Yukon, Nunavut.

Calculate Your Reimbursement:

For trips up to 5,000 km, multiply the total kilometres by $0.70.

For trips exceeding 5,000 km, calculate the first 5,000 km at $0.70 per km, and the remaining kilometres at $0.64 per km.

Example Calculation:

Let’s say you drove 7,000 km for work in 2024:

- First 5,000 km: 5,000 km × $0.70 = $3,500

- Remaining 2,000 km: 2,000 km × $0.64 = $1,280

- Total Reimbursement: $3,500 + $1,280 = $4,780

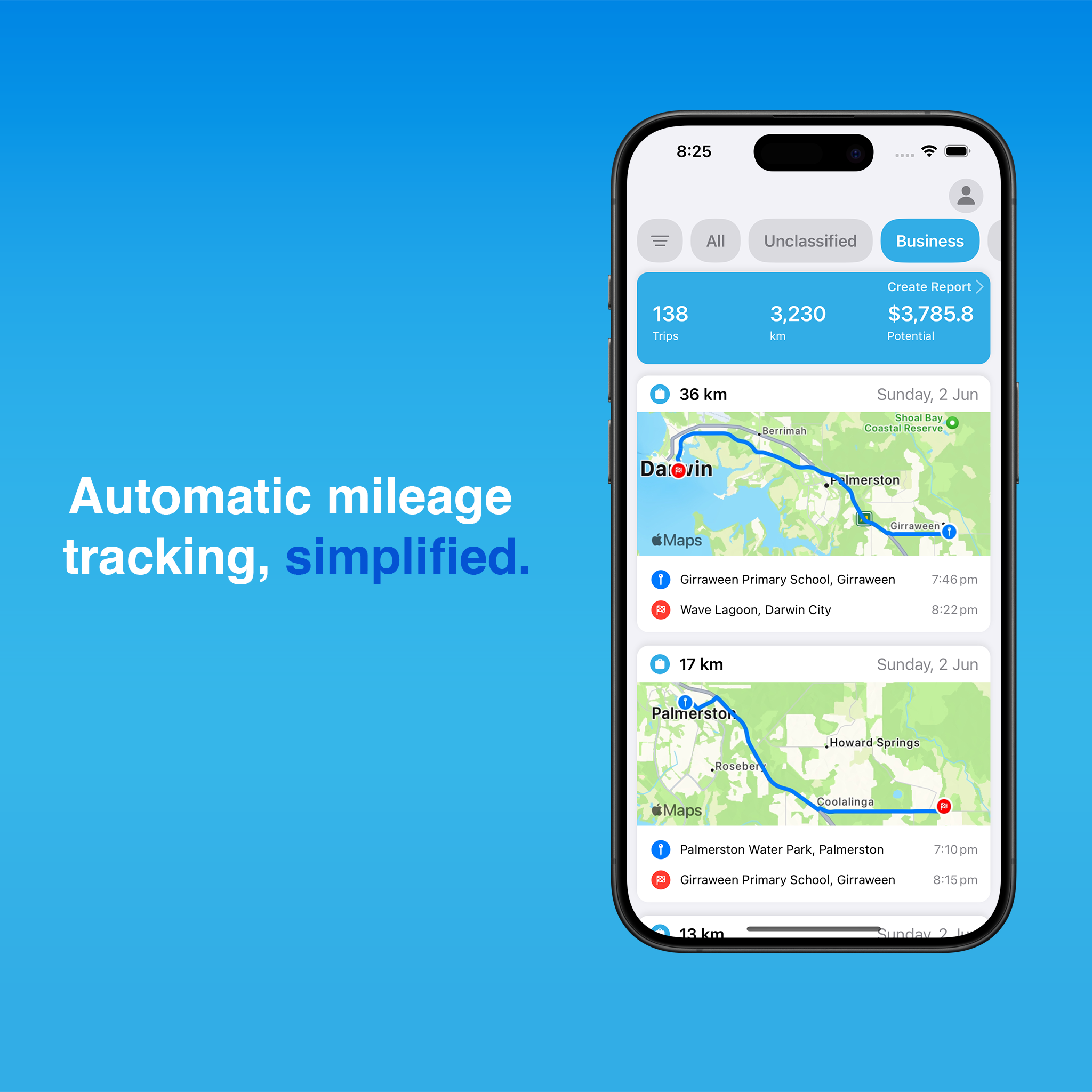

Streamlining your Claims with Technology

Calculating reimbursements using manually method is simple, but keeping a compliant mileage log can be a hassle. To simplify the process, consider using an CRA-compliant logbook app. These apps make it easy to automatically track your kilometres via your iPhone, ensuring that every trip is accurately recorded. You can quickly generate CRA-compliant reports in PDF or Excel formats, which are ready to share with your employer or accountant. This modern solution saves you time and effort, making it far more efficient than traditional logbook methods.